Research Seminar Series – AI-empowered FinTech

Date: 27 May 2022 (FRI)

Time: 4:00pm – 6:00pm (GMT +8, HK Time)

Conducted via Zoom

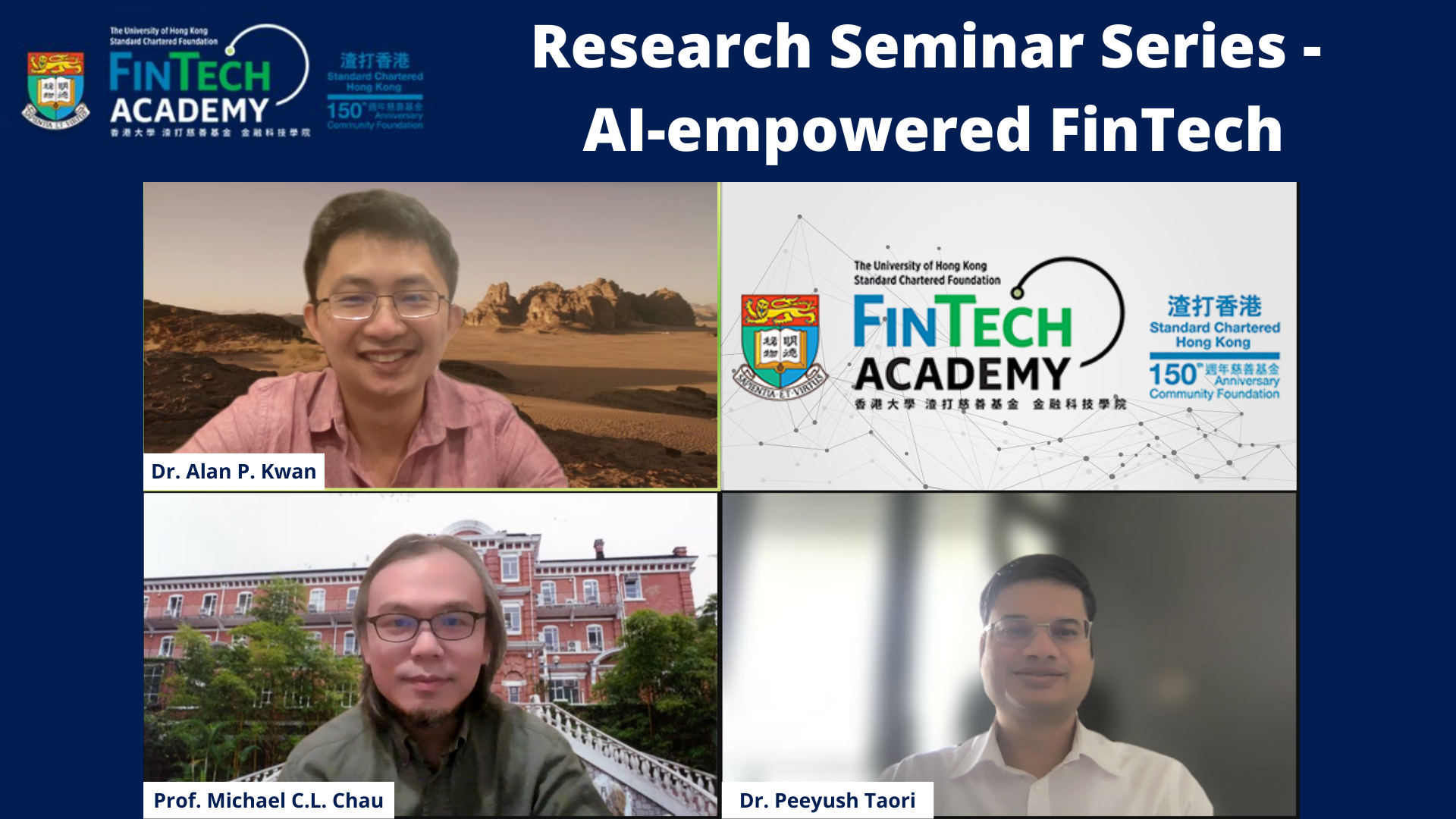

Prof. Michael C.L. Chau

Professor in Innovation and Information Management at HKU Business School

Project: A Deep Learning Model for Stock Return Prediction Using Social Media Data

Dr. Peeyush Taori

Assistant Professor in Accounting at HKU Business School

Project: Fake News Detection in Financial Markets: Methodology and Capital Market Implications

Dr. Alan P. Kwan

Assistant Professor in Finance at HKU Business School

Project: The Economic Applications of Firm-Specific Digital Footprints